Key Takeaways

- Citi introduced two client-facing assistants—AskWealth and Advisor Insights—to speed up answers and deliver timely market updates for wealth clients.

- AskWealth currently runs on Llama and is slated to move to Gemini; Advisor Insights is piloting now with more features planned.

- The launch sits inside a larger effort to modernize systems after past data-quality penalties; leadership continues to invest heavily in technology and controls.

- Citi reports widespread staff use of AI coding tools and ongoing cloud work—signals that AI In Banking is becoming part of daily operations.

Why AI In Banking Matters Right Now

Wealth clients expect clear answers, quick follow-ups, and context they can trust. AI In Banking is rising to meet those needs by collecting internal research, scanning market changes, and summarizing what matters—without drowning people in jargon. Citi’s new tools are a direct response to this reality, with designs that keep client conversations moving and reduce wait time for information. 1,2

What Citi Just Launched (and Why It’s Useful)

AskWealth: conversational answers for busy teams

AskWealth is a generative AI assistant for Citi’s wealth organization. It helps service teams and advisors pull market insights, house research, and policy guidance into simple responses, so clients get clearer answers in less time. The bank says AskWealth runs on Meta’s Llama models today and will shift to Google’s Gemini “over the next couple months,” reflecting an intent to pick the best model for each job. 1,2

Advisor Insights: a live dashboard for timely outreach

Advisor Insights is a machine-learning–driven dashboard that flags market moves, portfolio-relevant updates, and messages clients actually need to see. It’s in pilot within Citigold and Citi Private Client North America, with plans to expand in late 2025 and early 2026. Generative AI features are on the roadmap to make the tool even more adaptive.

Both assistants aim to cut hours of manual lookups and let bankers focus on the human side of the conversation—listening, clarifying goals, and tailoring next steps. 1,2

The Bigger Picture: AI In Banking Meets Modernization

These launches sit inside a wider multi-year effort to upgrade systems and data. Citi’s leaders have been direct: legacy platforms and fragmented data made some tasks slow and raised compliance risk. In 2024, U.S. regulators fined Citi $135.6 million tied to ongoing data-quality issues linked to a 2020 consent order—another push to accelerate fixes across platforms, reporting, and controls.1,3

In parallel, leadership has invested nearly $12 billion per year in technology, retired legacy apps, and simplified systems. The company also equipped about 30,000 developers with AI coding tools to speed secure software delivery. These steps are all part of making AI In Banking reliable at scale—because better tools only help if the data and plumbing behind them are sound.4

How AI In Banking Can Help Clients Day to Day

- Faster answers, fewer follow-ups. When an advisor can query AskWealth for research, definitions, or market context, clients get timely information without long delays.

- Relevant outreach. Advisor Insights highlights movements that actually affect a client’s portfolio or interests, helping advisors prioritize messages that matter.

- Clearer conversations. Summaries in plain language keep meetings focused. People leave with next steps instead of homework.1,2

Guardrails, Trust, and the Road Ahead for AI In Banking

Trust is earned when information is accurate, sources are traceable, and privacy is respected. Citi has stated that modernization efforts include cloud-based risk analytics, automated controls, and data governance—basics that support responsible AI In Banking.4,5

Regulators will continue to expect proof that systems are reliable and reports are correct. The most durable AI In Banking wins will come from solid data, tested models, and clear human oversight—especially in wealth settings where advice must reflect a client’s full picture.3

Inside the Tech (Without the Jargon)

We do not need to master model architecture to understand the direction. A few practical signals tell the story:

- Model flexibility. AskWealth shifting from Llama to Gemini shows a “right-tool-for-the-job” approach.1

- Cloud footing. Citi has discussed broader work with Google Cloud for AI and analytics, which supports scale and security patterns needed for AI In Banking.⁴

- Developer adoption. When 30,000 engineers use AI coding tools, updates ship faster and more consistently—vital for client-facing assistants that must improve week after week.⁴

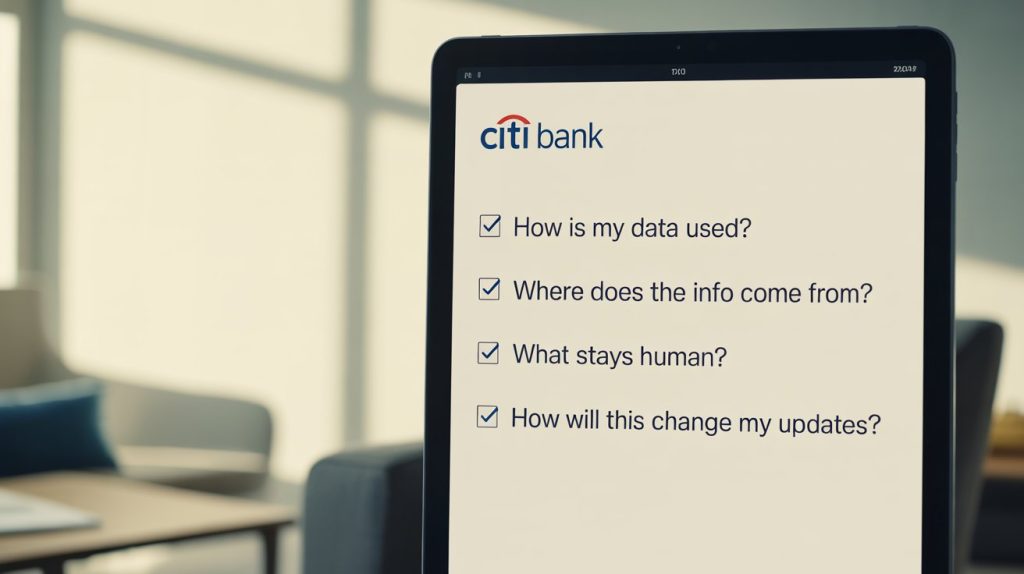

Questions to Ask Your Advisor About AI In Banking

1. How is my data used? Ask which systems access it and what protections are in place.

2. Where does the information come from? Request clarity on research sources and internal checks.

3. What decisions stay human? Confirm that advice, suitability, and final calls remain with people.

4. How will this change our cadence? See how AI In Banking may affect meeting schedules, alerts, and follow-ups.

What’s Next

Citi plans to broaden Advisor Insights from its U.S. pilot to more teams globally and keep upgrading AskWealth. The bank also signals more generative features are coming to the dashboard—another step toward context-aware updates that save time without adding noise.1,2

The direction is steady: modernize the stack, clean up data, and use AI In Banking to help clients get useful answers quickly. If those foundations hold, the advisors who know their clients best can spend less time hunting facts and more time making plans.

Citations

- Ashare, Matt. “Citi rolls out a pair of AI-powered banking platforms.” CIO Dive, 27 Aug. 2025.

- “Citi Wealth Launches ‘Advisor Insights’ Pilot and ‘AskWealth,’ AI-Driven ‘Gamechangers’ for Client Communications.” Citigroup News, 25 Aug. 2025.

- Ennis, Dan. “Citi to pay $135.6M in new penalties over 2020 orders.” Banking Dive, 11 July 2024.

- Ashare, Matt. “Citi deploys AI coding tools to 30K developers in modernization push.” CIO Dive, 16 Jan. 2025.

- “Strengthening Our Commitment to AI Innovation.” Citigroup Perspectives, 2025.